If one thing is for certain when it comes to travel nursing, it is that life is an adventure. You go where you want when you want- but that can all end during tax time. Suddenly, it becomes clear how much easier it is for workers who have a typical 9-5 cubicle job. Your tax situation is much more complicated. In this article, you’ll find a comprehensive travel nurse tax guide.

Additionally, if you’re looking to make some extra money on the side, check out some of these side hustles for nurses.

If you’re starting as a travel nurse, you are probably feeling overwhelmed. Rest easy because we’ve got resources for travel nursing and taxes.

5 Tax Challenges Faced by Travel Nurses

Travel nurses face 5 common challenges when filing taxes as a travel nurse. We’ll take a closer look at each one and help you deal with them.

Keep Good Records

You must make sure to keep detailed records if you plan to get the most out of your tax return. Here’s what you need to do:

- Keep copies of your contracts– this will help you prove where you worked and how long you worked there.

- Keep a mileage log– write down your odometer reading on January 1 and again on December 31. If you drive a second vehicle or you had rental or changed vehicles during the year, make sure to record that mileage as well.

- Save all your receipts– the IRS does give an allowance for meal costs, but you may need to document areas where you went over that allowance.

Maintain a Tax Home

A travel nurse tax home isn’t necessarily your residence. According to the IRS, it’s your “regular place of business/post of duty- regardless of where you maintain residence. This includes city/general area where your business/work is located. This allows you to make sure you accurately represent the way you travel to work to the IRS.

When you establish a travel nurse tax home, you can take deductions for travel expenses while ensuring the untaxed income in your contract remains untaxed. If they meet two of the three qualifications listed below, travel nurses will typically qualify for tax-free stipends:

- Have not abandoned your tax home

- Have earned at least 25% of your income in the geographical area

- Have a permanent residence

File in All States Worked In

Part of the allure of being a travel nurse is the travel. However, at tax time, this can be a disadvantage. You end up being required to file a tax return for every state. The taxes you’ll pay in each state will depend on several factors, including how long you worked there.

Face Down Audits

As a professional traveler, you are more likely to be audited- but don’t panic. If your wages seem low and your travel nurse tax deductions high, you may be flagged by the system. The good news is, there are things you can do to make it go smoothly.

- Save all receipts, contracts, and other documents for 7 years

- Make sure to stay above board- no cutting corners, understand tax laws, and carefully prepare your returns. Always assume that you may be audited

- Consult a professional if you are audited

Keep up with the Regular Stuff

One of the biggest challenges for travel nurses at tax time is reminding yourself of the tax benefits you are eligible for. This will help you get through it.

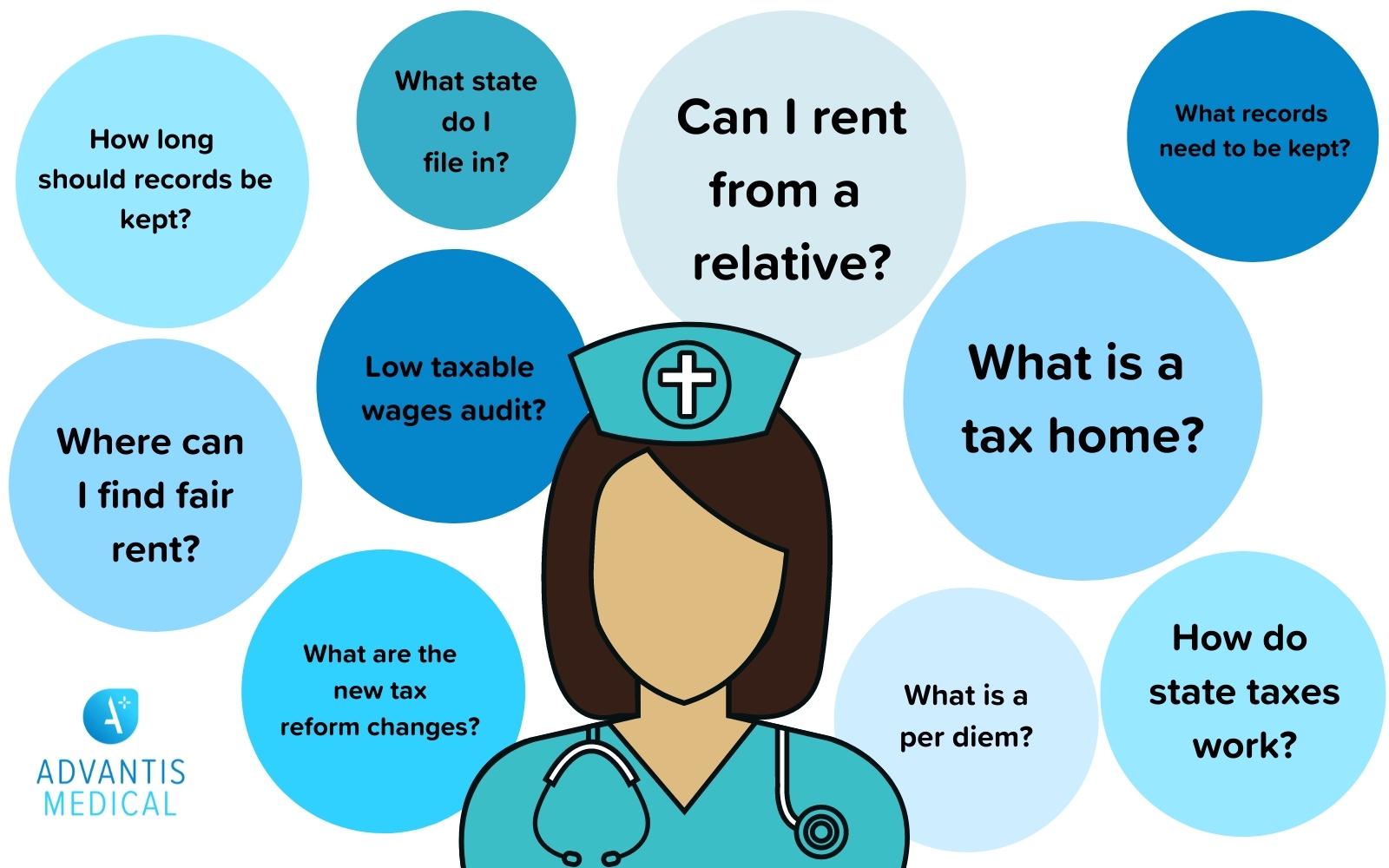

10 Common Tax Questions of Travel Nurses

Now that we’ve talked about the 5 tax challenges that travel nurses face let’s look at the 10 most common travel nurse tax questions that seem to come up.

What is a tax home?

One of the challenges mentioned above was maintaining a tax home. This is one of the most common questions travel nurses ask- and not just at tax time. Since this determines whether your subsidies, per diems, allowances, and stipends are taxable or not, this is an essential thing to think about.

As we mentioned, your tax home is the primary area of work where you have an annual income that is significant and recurring. If you don’t have a main income area, you can establish your tax home where you maintain a dwelling with substantial expenses that are duplicated when you are away from home on an assignment. Suppose you don’t have either of these. In that case, you are labeled as “itinerant,” which means all your stipends, per diems, allowances, and subsidies are taxable- including the value of provided housing.

Can I rent from my parents and establish that as my tax home?

Yes, you can do this. However, it must appear that you are not renting from a relative- meaning fair market rent or splitting annual costs to keep the home as roommates would in an apartment. Your parents must report this income on their tax returns.

Where can I find fair market rental rates in my area?

These days, this information is fairly easy to find. After all, we do live in the age of the internet. In the past, you would have to go to the newspaper classifieds. This is much easier now since newspapers are online. Gather some amounts based on similar accommodations- keeping in mind that you’re not just renting a room. You’re also renting bathroom and kitchen facilities. Never pay in cash- because, without documentation, it didn’t happen.

What state should I file in?

When it comes to filing taxes as a travel nurse, you must file in your home state and all the states you have worked in. If you have any legal ties with a state, you must file. If you don’t file in your home state or a state you’ve worked in, you are putting your license in jeopardy.

How do state taxes work?

Whether you worked in your home state or not, all income is taxed. The work state will also tax all income earned in that state. Your home state will credit you for taxes paid in other states- but if the taxes are higher in your home state, you must pay the difference.

What is a per diem?

A per diem is the maximum an employer can provide you with meals and lodging without receipts. Of course, they must do their due diligence and screen your tax home status. You can find per diem rates on GSA.GOV. These are not the standard or the minimum, and they are not a subsidy paid by the government to the agency.

What records should I be keeping?

When you file your taxes as a travel nurse, you must be able to justify the amounts you received tax-free. You must back up your travel pay with mileage logs, prove lodging expenses for lodging allowances, and always keep copies of your contracts. You may find that the best way to eliminate loss of travel nurse tax deductions is to work with an agency that pays these expenses.

How long should records be kept?

You need to be keeping your records for 7 years. If the IRS decides to rule the tax-free part non-qualifying, the statute of limitations on audits may be doubled. This means that they have that much more time to audit you.

Can I be audited for low taxable wages?

The short answer is yes. If your mortgage payment is large concerning your taxable income, you may be audited. Additionally, you might want to consider how your compensation affects your loan qualifications, workers’ compensation, social security, and disability.

What are the two major changes under the latest tax reform?

The first thing is, you can’t deduct employee business expenses. This means that the 2000-mile drive to your new assignment and back with a $300 travel pay cap each way can’t be deducted. Additionally, you can’t deduct expenses related to seminars. This will end up hurting travelers that work for agencies providing limited to no tax-free reimbursements.

Secondly, many states will begin to adjust their tax returns. Most of the forms or state taxes feed on IRS forms, but those are changing.

Conclusion

Travel nursing is a wonderful experience. You will make memories that will last a lifetime. However, when it comes to filing taxes as a travel nurse, you’ll find that it can be a headache. Luckily, when you know the challenges you will face, and have answers to common travel nurse tax questions, you can get through it. Plus, if you need help, our Nurse Care Team is only an email away in AdvantisConnect.