Navigating health insurance as a travel nurse can be complicated. Nurses working in permanent positions won’t have the same concerns as travel nurses: what if you take time off between assignments? Does your coverage follow you from state to state? Health insurance is not one-size-fits-all, and not all travel nurse agencies offer comparable benefits. Our guide will demystify the health insurance options available to travel nurses so you can make the best decision for your health needs and budget.

Health Insurance Options for Travel Nurses

Not all health insurance coverage is created equal. Here are the choices available to consider when reviewing your options as a travel nurse:

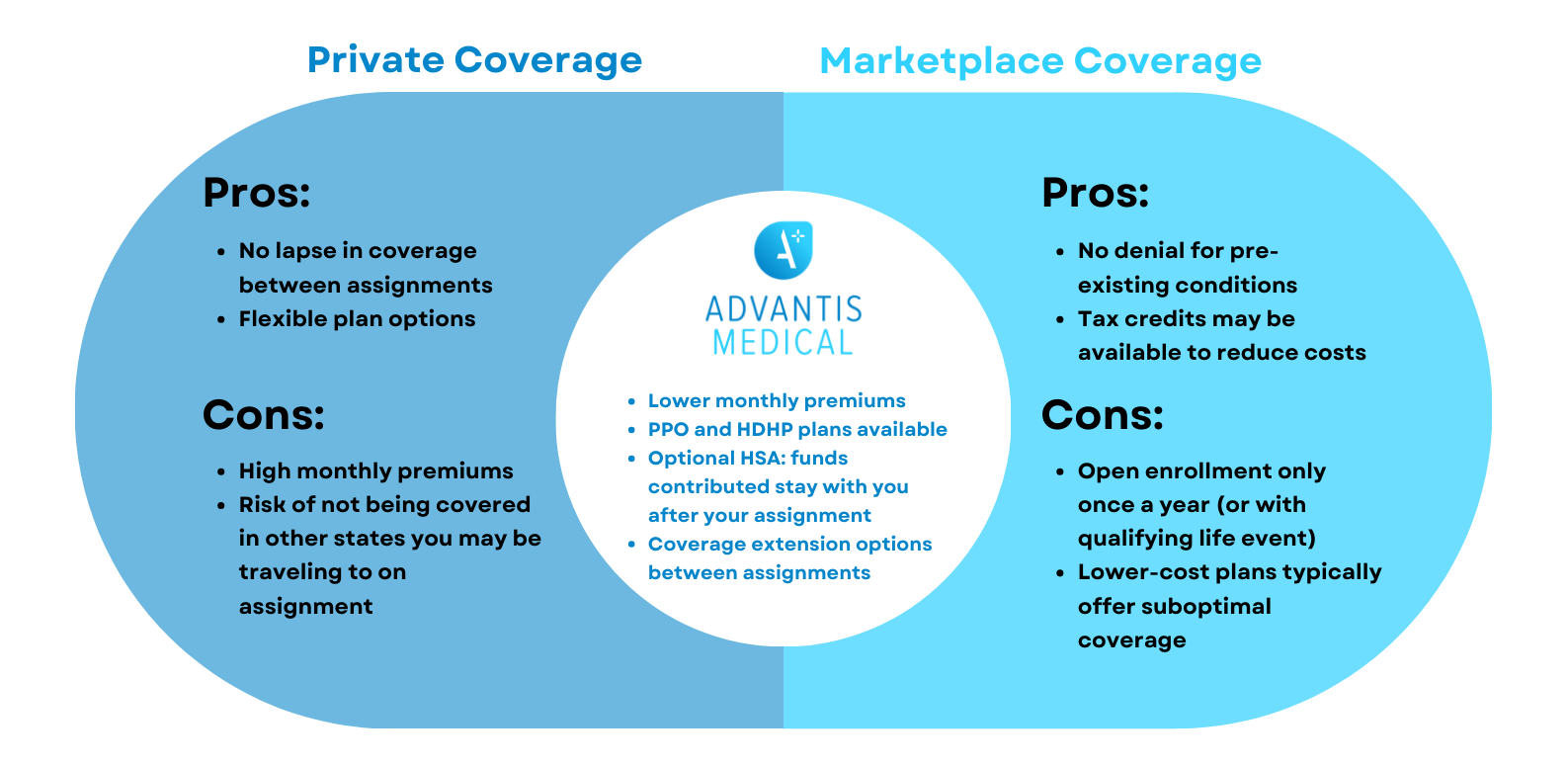

Healthcare Marketplace

The health insurance marketplace is a government-funded organization where people can purchase health insurance. If you’ve ever shopped for health insurance, you know it is a time-consuming and often deflating experience. These plans usually come with high deductibles and astronomical premiums, even though coverage is often mediocre. With the health insurance marketplace, open enrollment is only available November-January, so you’re stuck with the plan you choose until the following year unless you have a qualifying life event.

Private Coverage

Private health coverage options can be obtained through an insurance broker and are marketed by the private health insurance industry instead of government-run insurance programs. Each insurance provider sets their premium (the monthly cost) for coverage. These costs can vary widely depending on the coverage you choose, the insurer, if you are covering just yourself or a family, and the region where coverage is selected. Unlike the health insurance marketplace, private health insurance can be purchased regardless of the time of year or qualifying event.

While private health insurance and marketplace coverage ensures your coverage will not lapse between assignments, travel nurses often complain that the coverage is not worth the cost. There is also the possibility that these plans will not cover you in the state you are working.

Agency-Offered Coverage

Most reputable travel agencies offer comprehensive medical, vision, and dental health coverage, but some require a waiting period before taking effect. Advantis Medical believes nurses should be covered on day one of their assignments.

Coverage is often provided through a large insurance provider, so you can expect a quality plan available nationwide. Choosing your health insurance through your travel nurse agency will simplify life as there will only be a few plans to choose from. This option is also much more affordable than private health insurance, as your agency will cover part of the cost.

Supplemental Coverage Options

The following benefits can be elected in addition to a comprehensive medical plan.

Health Savings Account (HSA)

As a travel nurse who may move between states for assignments, having your own health savings account can ensure that the pre-tax dollars you elect for allocation to healthcare stay with you, no matter where you are. Selecting a high-deductible health plan with Advantis Medical makes you eligible for an HSA, which allows you to contribute money into an account to cover health-related costs.

There are many benefits to HSA accounts: the money you contribute isn’t taxed, it rolls over year to year, and you can gain interest, which also isn’t taxed. HSA funds can be used to pay for medical expenses, from prescriptions to chiropractor visits to corrective eye surgery. Certain Advantis Medical health plans offer this benefit; ask your recruiter for more details.

Accident Insurance

This supplemental coverage is in addition to a comprehensive medical plan. As the name implies, travel nurses are on the go and at risk for accidents and injuries. Accident insurance pays cash benefits that can be used to cover medical costs, equipment, and even cost-of-living expenses while recovering.

COBRA

The Consolidated Omnibus Budget Reconciliation Act, better known as COBRA, is a temporary extension of health coverage that can be elected when coverage is lost. While not an insurance option that can be chosen on its own, COBRA gives nurses the option to continue receiving their health benefits if taking several months off after an assignment. Heads up: COBRA coverage is very expensive, as your employer is no longer contributing to your premium.

Travel nurses with Advantis Medical who extend or begin a new contract within 30 days of their last assignment will experience no lapse in coverage. You can still take that extended vacation and keep your benefits!

Additional Voluntary Benefits

Along with comprehensive medical coverage, nurses may seek additional benefits like disability insurance or supplemental coverage for when life happens.

Disability Coverage

What if you’re injured or ill and unable to work? Short-term disability coverage usually starts one week after the disability and typically lasts a few months. Short-term disability includes back injuries (very common with nurses) as well as childbirth and maternity leave and replaces 50-80% of your income.

Life Insurance

While no one wants to think about it, would your family be taken care of if you weren’t around anymore? Life insurance offers peace of mind that your loved ones will be financially protected in the event of your death.

Hospital Indemnity Insurance

Sometimes the nurse becomes the patient. Hospital indemnity insurance is supplemental coverage that helps pay for costs related to a hospital stay.

Questions to Help You Choose The Right Travel Nurse Insurance

Speaking with your recruiter is the best way to compare your options and choose the best coverage. Consider the following questions to help you decide which health insurance fits your needs:

- Do you have a pre-existing condition?

- Do you require frequent specialist visits or expensive medications?

- Do you have a family that also requires coverage?

- Are dental and vision benefits a necessity?

- Are you generally healthy and do not take any prescribed medications?

- How do you feel about not having coverage if taking extended time off between assignments?

- Will your private plan cover you from state to state?

Benefits Nurses Can Expect With Advantis Medical

Along with high-paying assignments, Advantis Medical offers competitive benefits.

- Day 1 comprehensive insurance. Advantis Medical values travel nurses and allied health professionals and want you to feel secure from the start. We don’t make you wait 90 days before offering medical coverage. Medical, dental, and vision insurance is available starting on your first day of assignment. Advantis Medical offers several plans through Anthem Blue Cross to best fit your needs and budget.

- 401(k) plans. We invest in your future by offering 401(k) plans starting day one.

- Weekly direct deposit. No waiting for payday with Advantis. You can expect a timely direct deposit every Friday.

- Referral bonuses. Referrals are appreciated and rewarded with a $500 bonus.

- Relocation and travel reimbursement. You shouldn’t have to pay out of your own pocket to get to your assignment. Whether booking an airline ticket or filling your gas tank, Advantis Medical will reimburse you for your relocation expenses.

Deciding on health insurance coverage doesn’t need to be a tedious endeavor. If you don’t currently have health coverage or aren’t happy with your benefits, you can make life easier by selecting an agency-offered plan. If you have questions or concerns about your benefits, contact your agency’s benefits department.

Browse exclusive, high-paying travel job openings from the #1 rated travel nurse agency today! You can choose to work with one of our dedicated Pro Recruiters to receive white-glove service or express your interest in specific jobs directly on our individual job pages. Start your next adventure today by searching for exclusive travel nursing jobs with Advantis Medical Staffing!